jefferson parish property tax rate

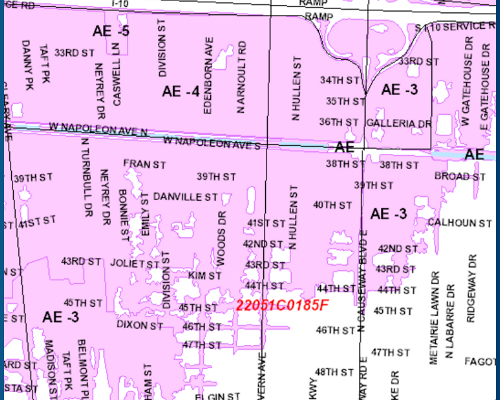

Whether you are presently. To find an estimate of your yearly taxes you start by multiplying the current Market Value by 10.

The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100.

. Overview of Jefferson Parish LA Property Taxes. WEST BANK OFFICE General Govt. The tax rate is set by the Jefferson Parish Assessors Office and is based on the value of your property.

Jefferson Parish Wards. The median property tax in Jefferson Davis Parish Louisiana is -1 per year for a home worth the median value of 2560. Learn all about Jefferson Davis Parish real estate tax.

Bldg 200 Derbigny St Suite 1100 Gretna LA 70053 504-362-4100 504-366-4087 EAST BANK OFFICE Yenni Bldg. This gives you the assessment on the parcel. Tax amount varies by county.

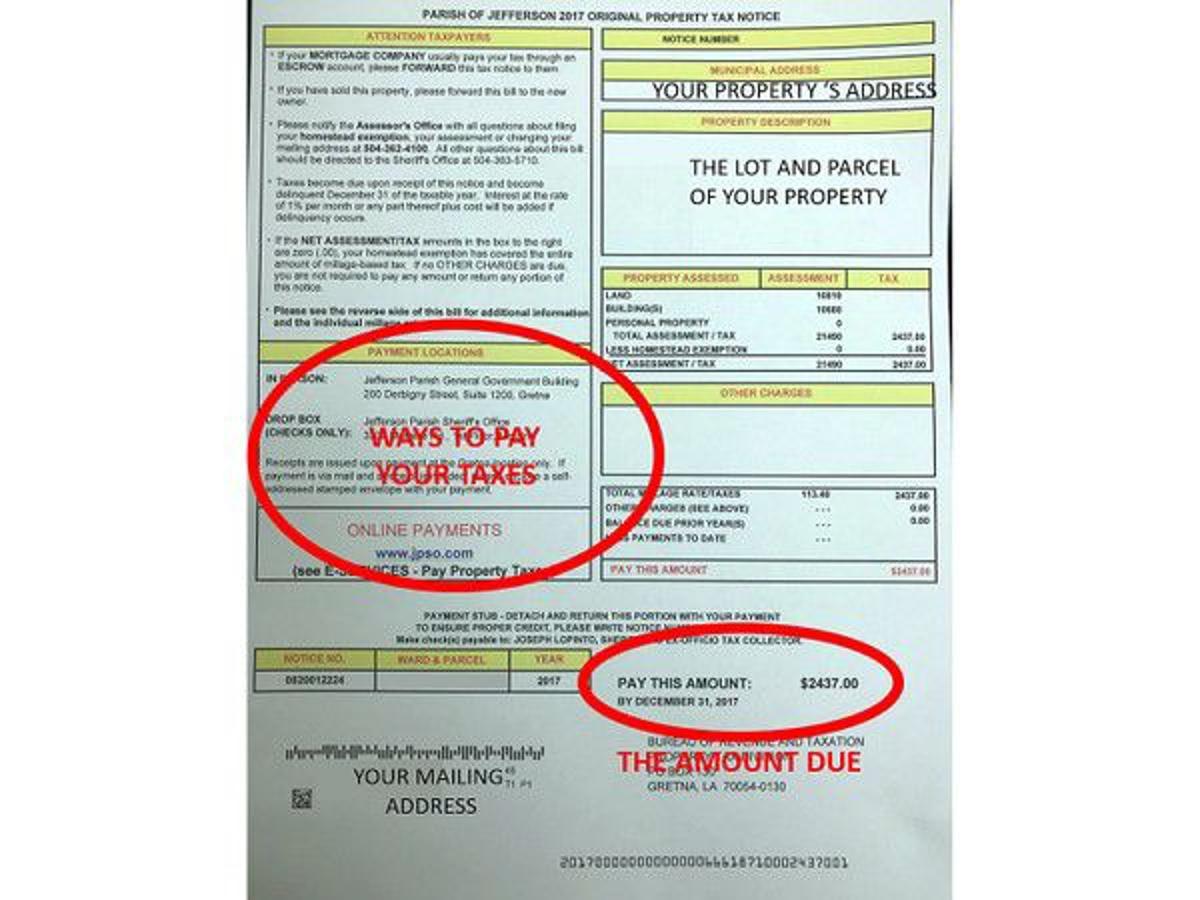

The median property tax also known as real estate tax in Jefferson Parish is 75500 per year based on a median home value of 17510000 and a median effective property tax rate of. 2021 Plantation Estates Fee 50000. The preliminary roll is subject to.

CLICK MORE for information about the program and how to participate. If you do not pay your. These taxes may be remitted via mail hand-delivery or filed and paid online via our website.

With this guide you can learn useful information about Jefferson Parish property taxes and get a better understanding of what to anticipate when you have to pay. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Whether you are already a resident or just considering moving to Jefferson Davis Parish to live or invest in real estate estimate local.

The tax is due on December 31st of each year. Property taxes are levied by millage or tax rates. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street.

Jefferson Parish is pleased to announce the opening of its 2022 First-Time Homebuyer Assistance Program. The average effective property tax rate in East Baton Rouge Parish is 061 which is over half the national average. A mill is defined as one-tenth of one cent.

If a Homestead Exemption HEX. For comparison the median home value in Jefferson Parish is. The median property tax in Louisiana is 24300 per year for a home worth the median value of 13540000.

Jefferson Parish collects on average 043 of a propertys. Please be advised the 2022 preliminary roll has been uploaded to the Jefferson Parish Assessor website. Jefferson Davis Parish collects on average -1 of a propertys.

If you are planning to buy a home in Jefferson Parish and want to understand the size of your property. 018 of home value. Jefferson Parish Property Search.

Most millage rates are approved when voted upon by voters of Jefferson Parish. If you have questions about how property.

Home Page Morehouse Parish Assessor S Office

Jefferson Parish Consolidated Plan Executive Summary

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

Supreme Court Ruling Louisiana Property Tax Ke Andrews

Jefferson Parish Sheriff S Office Jefferson Parish Sheriff S Office

How To Dispute Your 2023 Property Tax Assessment The New Orleans 100

About Assessors Louisiana Assessors Office

Jefferson Parish Consolidated Plan Executive Summary

Jefferson Parish 20 Raise For Deputies Could Mean More Taxes For Residents With Proposed Millage Wwltv Com

Jefferson Parish Assessor S Office Tax Estimate

Why Louisiana Property Owners Need To Pay Attention To An Ongoing Political Feud Louisiana Illuminator

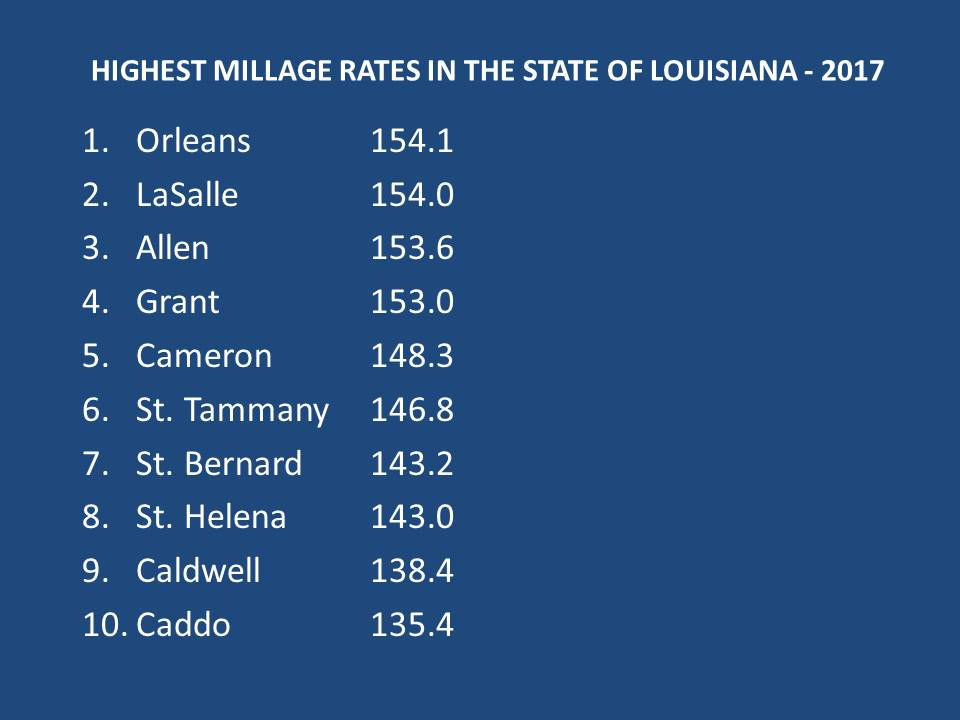

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans Archive Nola Com

Property Tax Finance And Administration St Tammany Parish Sheriff S Office

Louisiana Property Taxes Taxproper

Few Increases For 2019 Jefferson Parish Property Tax Rates So Far News Nola Com

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans