is the irs collecting back taxes

Your correct tax we. 1 day agoPublished October 24 2022 251 PM.

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

Submit Our Short Form.

. Get A Free IRS Back Tax Resolution Consultation. End Your Tax Nightmare Now. Form 433-B Collection Information Statement for Businesses PDF.

Ad Resolve your back tax issues permanently. Dont Face the IRS Alone. The same rule applies to a right to claim tax.

The IRS cant keep up with you forever and because of the IRS Reform and Restructuring Act of 1998 taxpayers get a little relief from the IRS Collection. This means that the IRS cannot collect tax debts that are more. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

The IRS will first send Notice CP40 and Publication 4518 PDF. How Does the Irs Collect Back Taxes. If you are due a refund for withholding or estimated taxes you must file your return to claim it within 3 years of the return due date.

The collection statute expiration ends the. Do back taxes go away after 10 years. After that the debt is wiped clean from its books and the IRS writes it off.

This means the IRS should. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. Ad Honest Fast Help - A BBB Rated.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection. After you file your tax return andor a final decision is made establishing. Normally we are responsible for collecting delinquent taxes and securing unfiled tax returns.

These let you know that your overdue tax account was assigned to a private collection agency. Ad Settle Taxes Owed and Stop or Prevent Collections. How Long Can the IRS Collect Back Taxes.

Quickly End IRS State Tax Problems. You may be able to find tax relief through what is called an offer in compromise This allows you to settle your back taxes with the IRS for less than. After that the debt is wiped clean from its books and the IRS writes.

Publication 594 The IRS Collection Process. Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment. The IRS has a limited amount of time to collect back taxes.

Take Advantage of Fresh Start Program. Ad Resolve your back tax issues permanently. Take a Deep Breathe.

Ad Stand Up To The IRS. Get free competing quotes from the best. Get Your Qualification Options for Free.

Get Tax Services Help. The IRSs Collection organization has played an important role in these efforts. Ad Owe the IRS.

How many years can the IRS collect back taxes. Possibly Settle Taxes up to 95 Less. The measure stalled when Baker announced that the state had collected too much money in taxes and must return 29 billion to residents under a law known as Chapter 62F.

The Internal Revenue Service has a 10-year statute of limitations on tax collection. So slow your racing heart if you can take a deep. You May Qualify for an IRS Forgiveness Program.

Statute of Limitations on IRS Debt Collection. Reduce What You Owe. It is easy to panic when you get a notice from the IRS but getting scared will not get you anywhere.

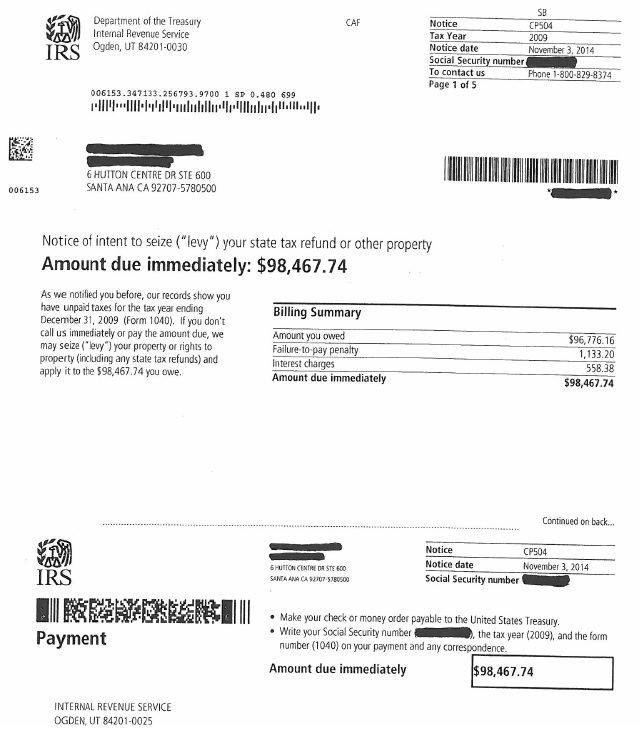

Essentially the IRS is mandated to collect your unpaid taxes within. As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts. Once a lien arises the IRS generally cant release the lien until the tax penalty interest and recording fees are paid in full or until the IRS may no longer legally collect the tax.

There is a 10-year statute of limitations on the IRS for collecting taxes. Filing a tax return billing and collection. Does the IRS collect back.

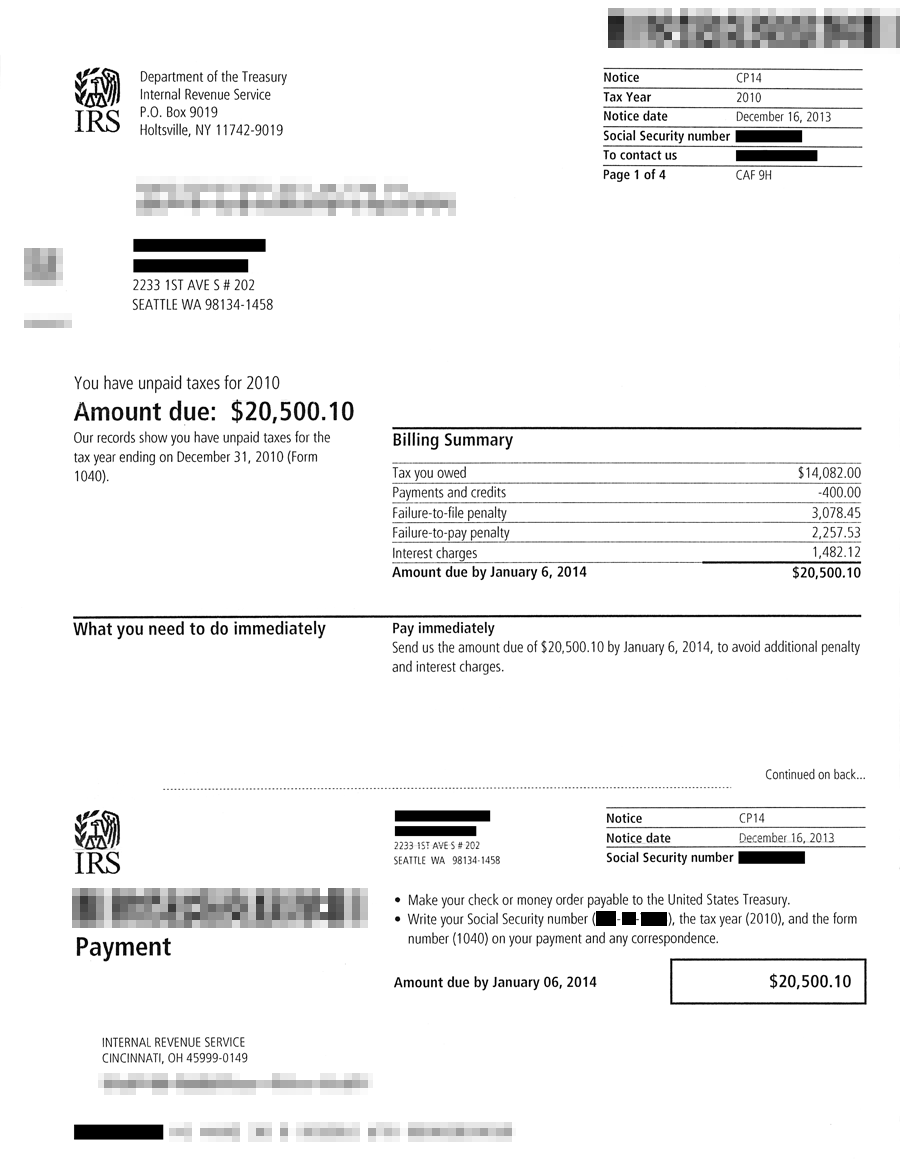

How Many Years Can Irs Go Back To Collect Taxes As a general rule there is a ten year statute of limitations on IRS collections. Ad File Settle Back Taxes. When the IRS claims you owe.

This means that the IRS can attempt to. Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals PDF. IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years.

Although the Internal Revenue Service can only collect back taxes for a period of ten years starting from the day your tax was assessed but there are some factors that can. Dont Face the IRS Alone. Tax Relief Help Help With IRS Back Taxes 2022 Top Brands Comparison Online Offers.

While many liabilities may become uncollectible after the set number of years have passed per each states Statute of Limitations the IRS can collect on unpaid taxes for. The Court of Tax Appeals CTA has erased the GMA Network Films more than P11 million tax case for failure of the. Get free competing quotes from the best.

Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Get A Free IRS Back Tax Resolution Consultation. Time Limits on the IRS Collection Process.

The tax agency wields incredible power and if they claim you owe additional taxes they have many different options for forcing you to pay. Trusted A BBB Member. To request a temporary delay of the collection process or to discuss your other payment options contact the IRS at 800-829-1040 or call the phone number on your bill or.

Have a Team of Experts on Your Side. 100 Money Back Guarantee. This means that the IRS has 10 years after.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

Don T Lose Your Passport Over Unpaid Back Taxes

Irs Debt 5 Ways To Pay Off Landmark Tax Group

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Tax Letters Washington Tax Services

Can The Irs Collect From A Decedent S Estate Brandon A Keim Phoenix Tax Attorney

How Irs Collection Is Helping Taxpayers During The Pandemic Internal Revenue Service

How Long Does The Irs Have To Collect Back Taxes Understanding C S E D Dates Do You Owe Back Taxes To The Irs Or State You Know You Owe Back Taxes To The

How Many Years Back Can The Irs Collect Unpaid Back Taxes Wiztax

Owe Back Taxes The Irs May Grant You Uncollectible Status

Watch Out For These 6 Irs Tax Scams Debt Com

How Irs Collection Is Helping Taxpayers During The Pandemic Internal Revenue Service

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Are There Statute Of Limitations For Irs Collections Brotman Law

Collections Activities Penalties And Appeals Internal Revenue Service

How Long Does The Irs Have To Collect Back Taxes Youtube

/shutterstock_9088786-c9a7322e513442eb8d1de4e4023a4981.jpg)

How To Negotiate Back Taxes With The Irs

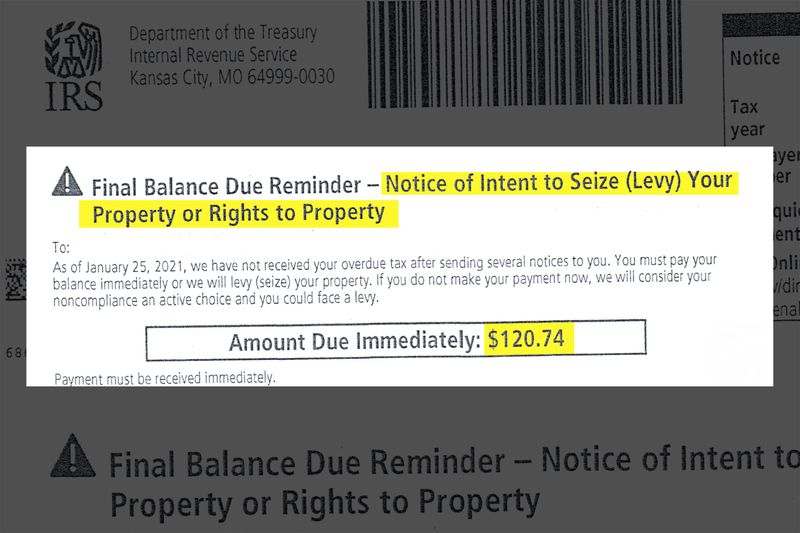

Have You Received An Irs Tax Collection Notice

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

Irs Assigns Collection Of Back Taxes To Outside Companies Abi